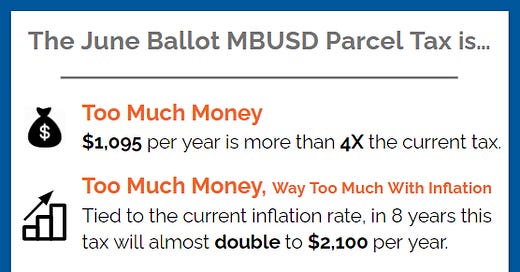

The proposed tax hike on the June 7 ballot - almost 5 times greater than the current tax - has raised some eyebrows. The proposed parcel tax is an additional $12 million ($1,095/parcel) on top of the current tax of $2.5 million ($225/parcel), and increases yearly for 12 years.

Don’t feel like the Lone Ranger if you are feeling compelled to “Vote NO” on the additional parcel tax. In a survey of residents taken last fall, only 15% of residents said there was a “great need” to increase funding for MB schools, and only 1 in 3 was a “definite yes” to hike taxes by even $6 million ($525/parcel). Survey results

In addition to the tax amount being a problem, a loophole is being used by a handful of citizens in an attempt to pass the tax measure with only 50% +1 of the votes. Citizen-led initiatives are not held to the 2/3 (67%) standard for ratification as are other tax measures. Residents are saying this seems like a trick to bypass the normal safeguard of a supermajority needed to levy taxes on citizens.

The survey also showed that residents were highly interested in academics, high-quality teachers, and accountability about how the money is spent as a requirement for any tax measure. However, the $12 million ($1,095/parcel) measure on the ballot has a broad definition of how the money is going to be spent and a vague statement about an “independent citzen’s committee” providing oversight.

It is odd that in March, the School Board passed a resolution to ask residents for an additional $375/parcel or $4 million and to make the current tax of $2.5 million ($225/parcel) permanent and add an annual inflation adjustment, yet the $12 million tax hike makes its way on the ballot. It makes no sense.

The Board was going to ask for a $4 million tax increase, but then a citizens’ group is now asking for $12 million. Where are these added millions going to be spent? Could it be to cover the undisclosed cost of the extensive, 12-page “Action Plan” of the Equity, Diversity, Social Justice and Inclusion Committee (EDSJI) that was adopted by the School Board on 4/20/22? EDSJI Action Plan. The Board failed to explain how much it was going to cost. The plan calls for lots of additional personnel, extensive teacher training and certifications, testing, student surveys, new study books and literature, library resources, and additional facilities on every campus.

Additional Facts:

The tax funds will begin to flow in Spring 2023 and they will increase every year, for 12 years.

This 12-year tax hike will have to be extended permanently because there is no way the School Board would reduce expenses when the taxes are scheduled to expire.

Tenants would not be exempt from this tax, as tax increases are generally passed on to the renter.

The citizen’s group included an exemption for seniors in the measure, attempting to increase the odds of a favorable vote from this demographic.

Second homes are not exempt.

Another reason to “Vote NO!” is to stop other special interest groups from colluding with the school board or other government agencies to hike taxes with a simple majority of 50% + 1 instead of the normal 67%.

Email WeTheParentsMB@gmail.com to get your yard sign.

(a suggested donation of $10 is appreciated)

About MBStrong…

Click the link to learn more about us.

Get the app and notifications when we post a newsletter.